BlackRock Files for More Bitcoin Exposure via $36B Fund

BlackRock, the largest global asset manager, plans to increase its Bitcoin exposure through its $36 billion Strategic Income Opportunities Fund by purchasing more Bitcoin ETFs.

BlackRock, the largest global asset manager, plans to increase its Bitcoin exposure through its $36 billion Strategic Income Opportunities Fund by purchasing more Bitcoin ETFs.

Nattynatman

Share

BlackRock, the world's largest asset manager with $10 trillion in assets, has made a significant move in the crypto market. The firm, with its Strategic Income Opportunities Fund valued at $36 billion, has filed to purchase more Bitcoin exchange-traded funds (ETFs), signalling its intent to increase exposure to the digital asset.

This decision comes amid a surge in popularity for Bitcoin ETFs, particularly after the approval of a Spot Bitcoin ETF on January 10th earlier this year.

BlackRock's ETFs have been outperforming others in trading volume, commanding nearly 50% of the total Bitcoin ETF trading volume daily. Recent statistics indicate a substantial flow of funds into Bitcoin, with BlackRock's volume hitting $2.4 billion, recording the second largest day of trading volume since launch.

The timing of this move is notable, coinciding with Bitcoin's rise to $68,000 in USD terms, already surpassing its previous all-time highs in EUR and AUD terms. BlackRock's contributions have played a significant role in propelling the price of Bitcoin to these levels, establishing the multinational firm as a key player in the crypto market.

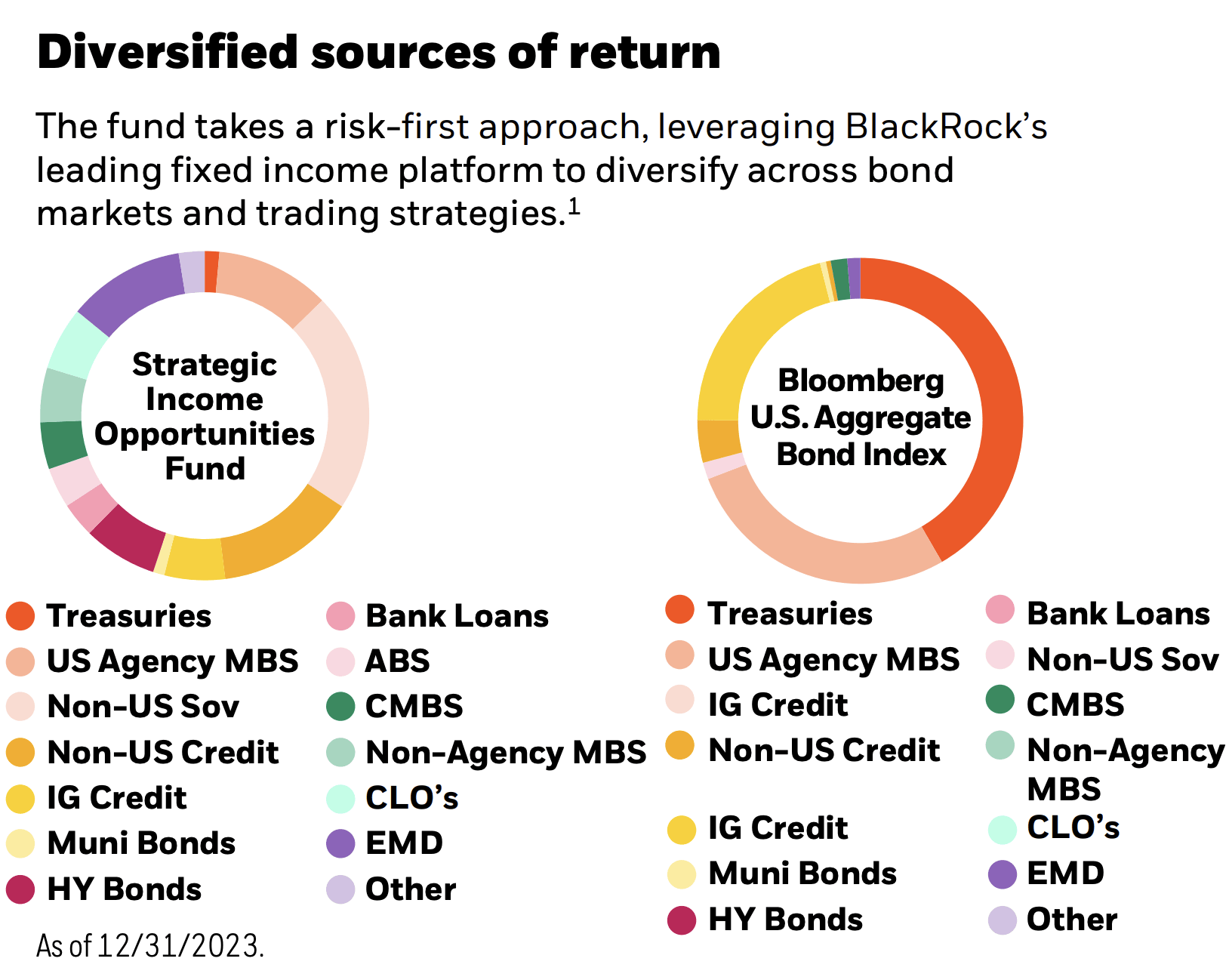

In a filing with the Securities and Exchange Commission (SEC), BlackRock outlined its intention to acquire shares in Bitcoin exchange-traded products (ETPs), including those directly holding Bitcoin. This move aligns with the investment strategy of the Strategic Income Opportunities Fund, a flexible bond strategy designed to offer investors attractive returns and portfolio diversification.

As of December 31, 2023, the fund's allocation reflects its commitment to a diverse investment approach. With BlackRock already holding more than $11 billion in Bitcoin, this move further solidifies its position in the crypto market and serves as a signal for other global fund managers to consider Bitcoin exposure.

With the anticipation surrounding prospective new Bitcoin ETFs, BlackRock aims to enhance the Strategic Income Opportunities Fund, providing its clients with a stronger investment product in the ever-evolving landscape of digital assets.

Recommended by Pluid

News

by darwizzynft

News

Jul 31, 2025

News

by darwizzynft

News

Aug 20, 2025

News

by darwizzynft

News

Sep 19, 2025

News

by darwizzynft

News

Aug 20, 2025